Building Insurance Increases

Building Insurance Increases 65 Percent For New Homes

What impact will rising insurance costs have on home buyers and builders?

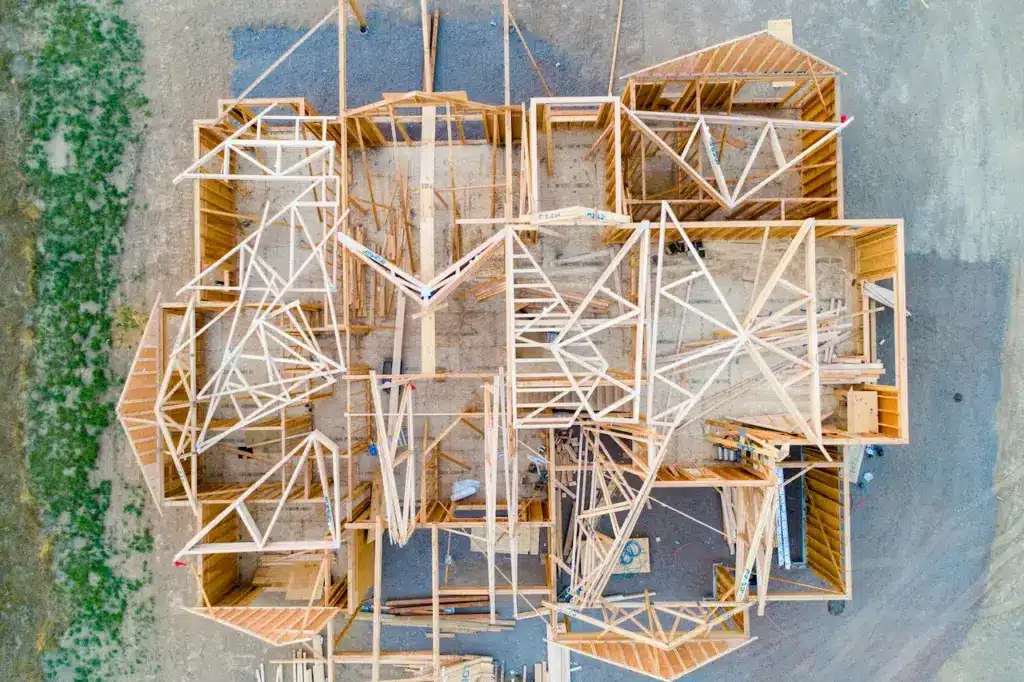

Building Insurance To Increase 65 Percent For New Homes. Due to the sharp rise in insurance costs for domestic construction, new-home builders are under significant financial strain in Victoria, Australia. The increase in domestic building insurance costs is a result of a series of collapses that have left thousands of unfinished homes and led to record payouts from Victoria’s state-backed insurer. Builders will be seeing a 65% increase in insurance premiums starting August for new homes, multi-unit housing, and owner-builders. This article explores the effects of increased insurance costs for builders, home buyers and the construction industry as a whole, as well the economic factors that are exacerbating this situation.

Rising insurance premiums are a blow to home buyers and builders

The Victorian Managed Insurance Authority has announced an increase in charges for domestic buildings insurance of up to 53% on average from 6 August. The previous premium hike was 43%, just 11 months earlier. This latest increase includes a rise of 65% in premiums for owner-builders, new homes, multi-unit dwellings and single-family homes. Insurance for renovations is also expected to increase by 20%.

VMIA spokesperson noted that over 4,000 domestic insurance claims have been resolved since July 1, 2023. The increase in claims started with the collapse in March 2023 of Porter Davis, and continues as more and more builders are facing insolvency because of rising labor and material costs. The VMIA is now under financial stress due to these issues, which have led to current premium increases.

Economic Pressure on Builders

Builders who are already facing economic difficulties will be particularly affected by the increased insurance rates. According to the Housing Industry Association (HIA), a home with a contract worth $500,000 would see a premium increase from $3,872 up to $6,388.80. Keith Ryan, HIA executive director for Victoria stated that the move will further reduce housing affordability and increase financial pressure on home builders.

Ryan stressed that these costs would be passed onto new home buyers, further complicating an already difficult market. He pointed out that a typical Melbourne home already costs over 40% in taxes, fees and charges. This effectively locks thousands of Victorians from home ownership.

Impact on Home Buyers

The increased costs of insurance are passed directly on to home buyers. This is because the increase in insurance costs adds to overall home building costs, making it harder for potential buyers to buy a house. This is a particularly worrying situation in Victoria where housing affordability has already become a major issue.

Jess Wilson, the finance spokesperson for the opposition, criticised the government’s mismanagement of the public insurer. She argued that this mismanagement led to the current crisis. She said that premium increases will only worsen Victoria’s housing affordability crisis. Home buyers and renovators would be left with higher costs, but no added benefits.

Construction Industry Economic Challenges

Insolvencies of Builders and Market Dynamics

Porter Davis, Montego Homes and other high-profile collapses have marked the construction industry. Porter Davis’s collapse has left 1,700 homes in Victoria and Queensland without a home. 560 clients are not covered by their insurance, despite paying the construction giant prior to its liquidation. To deal with the fallout, the Victorian government set up a bailout program of $15 million.

Montego Homes entered voluntary administration on January 20, 2024, due to rising construction costs. The Victorian Building Authority reported that Montego Homes had not taken out domestic building insurance on 64 sites, despite having received nearly $900,000. The VMIA has been put under more financial pressure as a result of these insolvencies. They have also increased regulations and fines.

Professional Indemnity Insurance Market

There are signs that the market for professional indemnity insurance (PI) in the construction industry is improving despite the challenges. Clyde & Co says that the demand for insurance services is high and is expected to increase. James Rigney is a partner with Clyde & Co. He noted that insurance companies and brokers are experiencing a shift of risks for their clients, as a result of a more regulated environment and an increased scrutiny towards building professionals.

Since the building defect crisis of 2018/2019, the construction PI industry has become more regulated, resulting in higher costs for design, construction and approval processes. These changes have led to an increase in builder bankruptcy, with significant financial and legal implications for architects, engineering firms, and insurers.

Long-Term Growth and the Softening of the PI Market

Rigney noted that the softening of the PI markets has attracted more insurance companies to Australia, making it easier and cheaper to get insurance for clients in the construction industry, especially for larger and mid-level organizations. He pointed out that major construction projects such as renewable energy initiatives and Brisbane Olympics 2032 are expected to drive growth in the engineering and construction sectors.

Ongoing Challenges

Construction industry still faces serious challenges despite these positive signs. The Australian Bureau of Statistics reports that the construction industry’s insolvencies have increased by over 30% since 2023. Over 2,500 companies became insolvent in this financial year. The economic indicators are indicative of a broader problem. In April, the economy grew by just 0.1% and GDP per capita has been falling for five quarters.

The Cost of Building and its Effects on Buyers and Builders

Impact on Buyers

The increased cost of insurance adds to the financial burden for home buyers. The increased costs of insurance premiums are added to the existing financial burdens such as high property values, taxes and fees. This may lead to many potential buyers being priced out of the market. This will further exacerbate the housing affordability crisis.

Impact on builders

Due to rising insurance costs, material and labor prices, and other economic factors, builders are under significant financial pressure. These pressures may lead to construction delays, decreased profitability and, in some instances, insolvency. Increased scrutiny and regulatory requirements add to the administrative burden and financial burden of builders.

Cost of Building

Due to increased insurance rates and other economic factors, the cost of building a new home has increased significantly. The cost of materials and labor has increased, along with the costs associated with adhering to stricter regulations. These costs are passed onto home buyers and contribute to the affordability crisis.

Conclusion

Construction in Victoria is currently facing a perfect hurricane of economic challenges, rising costs, and regulatory pressures. This storm puts significant pressure on both builders and home buyers. This broader crisis is reflected in the sharp rise in domestic building insurance rates. However, it also highlights the inter-connectedness of these issues. Will it make you buy and renovate your home over building?

Builders face a complex environment of rising costs, increased regulation, and economic uncertainty while trying to provide quality homes for buyers. Home buyers face greater costs and financial barriers, which exacerbate the housing affordability crisis that already exists in Victoria.

All stakeholders will need to work together in order to overcome these challenges, including the government, insurance companies, and industry. To ensure a sustainable housing market, it is essential to reduce the financial burden of builders and buyers. This will require improved regulatory frameworks and a more resilient and stable construction industry.

Stakeholders can develop solutions to the challenges of the construction sector and increase its long-term stability by understanding the impact of insurance costs on the industry.